is a tax refund considered income for unemployment

Yes the IRS is mailing refunds to some taxpayers who claimed unemployment benefits. This benefit is a reduction in taxable income which usually results in a refund of some kind.

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

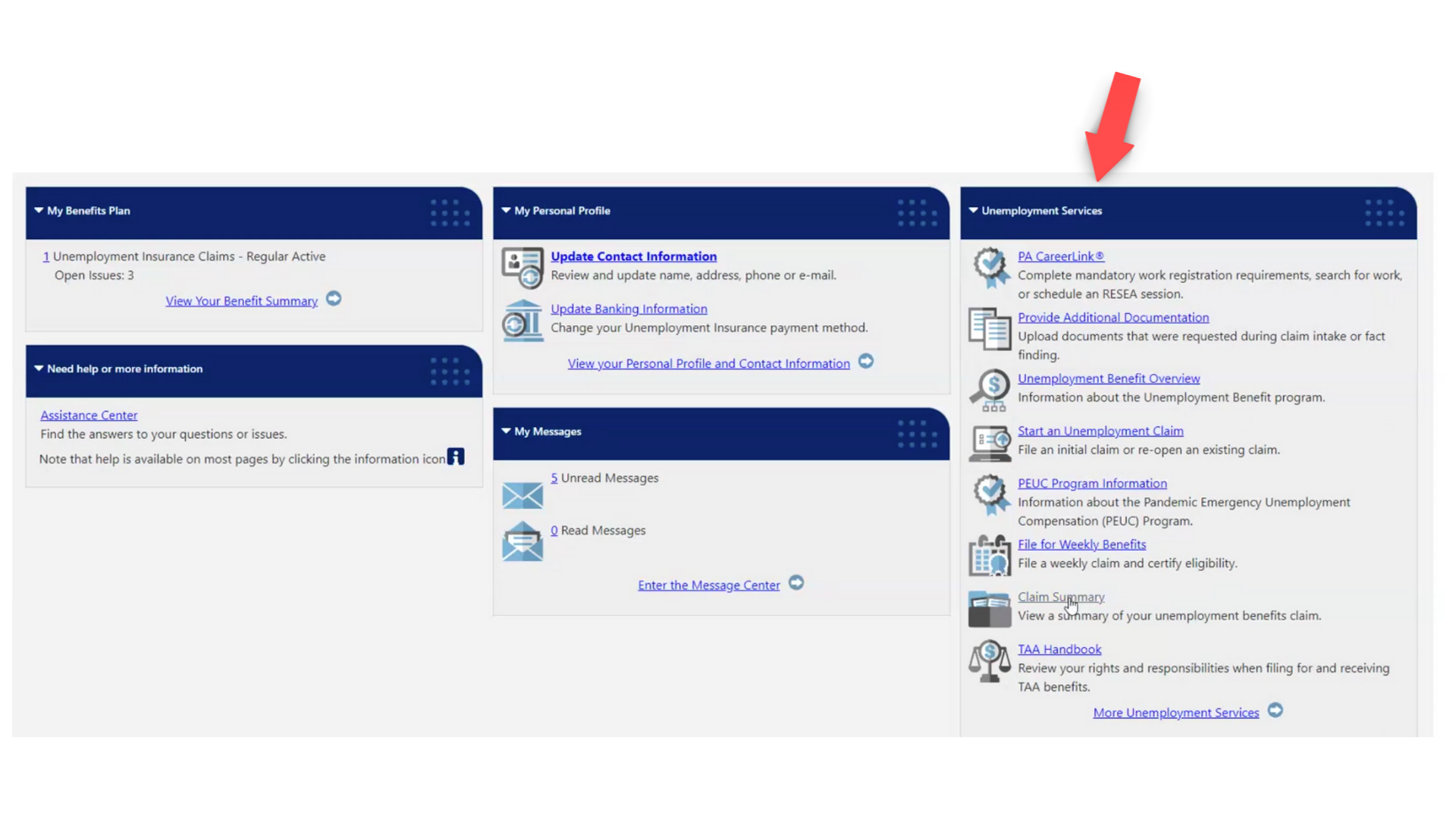

How to check your irs transcript for clues.

. A quick update on irs unemployment tax refunds today. The refunds you receive from your state income tax returns may be considered income. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income.

Income and Taxes if you have been Unemployed. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Make sure you include the full amount of benefits received and any withholdings on your tax return.

How much will I get back from unemployment taxes. So if you collected unemployment benefits in 2021 you should expect 100 of your benefits to be included in your taxable income when you file your 2021 tax return. Tax season started Jan.

How much you receive will depend on how much tax you paid on your unemployment income in 2020. To report unemployment compensation on your 2021 tax return. The federal tax code counts.

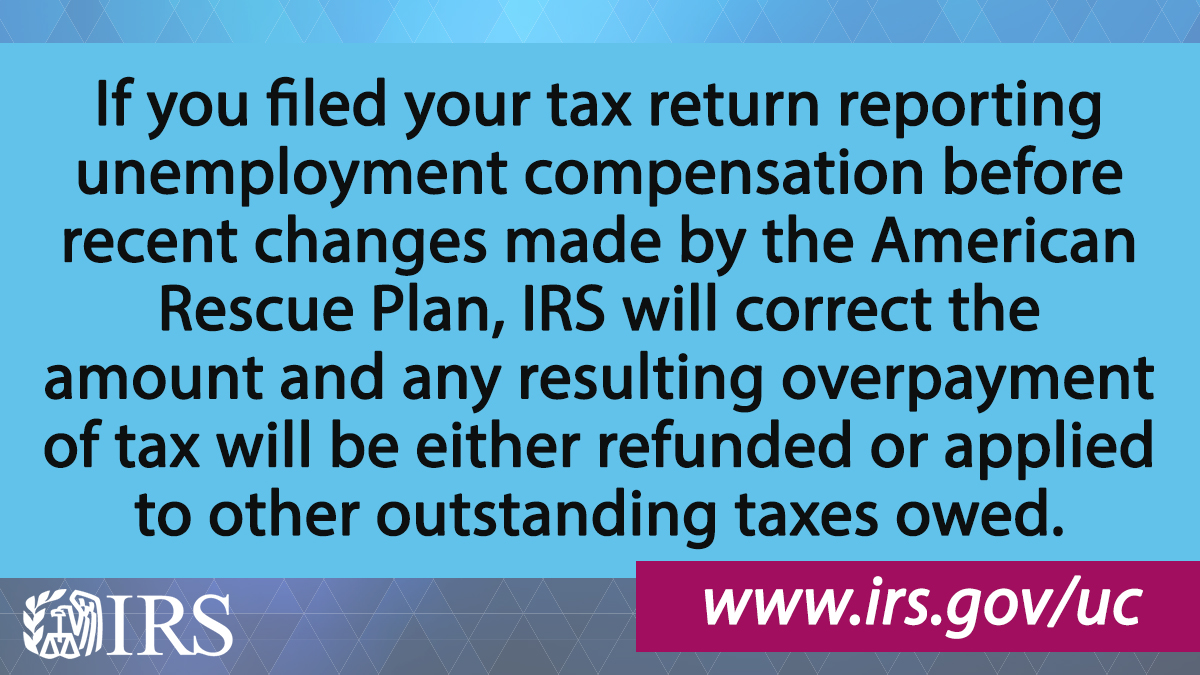

Unemployment compensation is considered taxable income by the IRS and most states thus you are required to report all unemployment income as reported on Form 1099-G. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment benefits. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable.

The 10200 is the refund amount not the income exclusion level for single taxpayers. The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021. Unemployment income is considered taxable income and must be reported on your tax return.

The IRS has sent 87. Not every state assesses a tax on. It could be a difficult tax year for some people who received unemployment benefits in 2020 but didnt realize those payments are taxable income.

Receiving unemployment benefits is no different from earning a paycheck when it comes to income taxes at least under normal circumstances when the US. The questions indicates that you are in the incorrect data entry for the unemployment compensation form 1099-G you have somehow selected Other 1099-G. Gary Crawford and Susie Latta Kanas State University Extension tax expert Duration.

For reference the average refund is around 1600. The IRS is mailing refunds to people who claimed unemployment benefits as income and filed their taxes. This benefit is a reduction in taxable income which usually results in a refund of some kind.

In fact unemployed people often receive a larger than usual income tax refund as the payroll department. How much you receive will depend on how much tax you paid on your unemployment income in 2020. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form.

The big question for this special type of refund is whether or not the unemployment income needs to. 24 and runs through April 18. It depends on whether you deducted state and local income taxes in your tax returns the.

Unemployment benefits are typically only subject to federal income taxation. Unemployment Payments Are Considered Taxable Income by the IRS. A large tax refund will not affect your unemployment benefits.

It is included in your taxable income for the tax year.

1099 G 1099 Ints Now Available Virginia Tax

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours Mlive Com

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

Taxes 2021 What To Expect For The 2021 Tax Season Tax Foundation

Irs Issues More Tax Refunds Relating To Jobless Benefits

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Unemployment Benefits Tax Issues Uchelp Org

1099 G Tax Form Why It S Important

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Xgvjz1gws7

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back